Canada's COVID-19 Economic Response Plan

Prime Minister Justin Trudeau unveiled the $82-billion aid package on March 18, 2020.

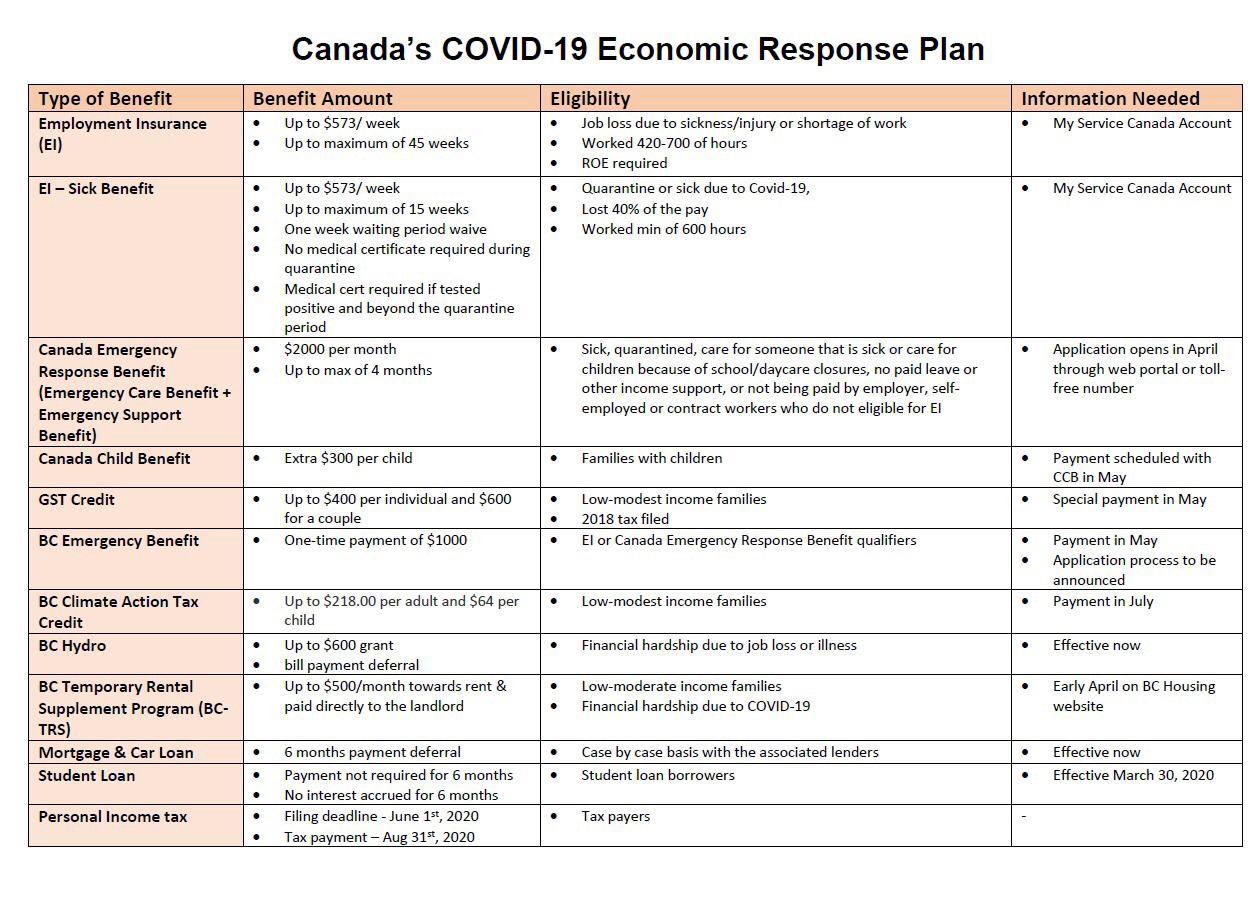

Employment Insurance (El) • Up to $573/ week • Up to a maximum of 45 weeks • Job loss due to sickness/injury or shortage of work • Worked 420-700 of hours • ROE required •

El —Sick Benefit • Up to $573/ week • Up to a maximum of 15 weeks • One week waiting period waive • No medical certificate required during quarantine • Medical cert required if tested positive and beyond the quarantine period • Quarantine or sick due to Covid-19, • Lost 40. of the pay • Worked min of 600 hours •

Canada Emergency Response Benefit (Emergency Care Benefit + Emergency Support Benefit) • $2000 per month • Up to a max of 4 months • Sick, quarantined, care for someone that is sick or care for children because of school/daycare closures, no paid leave or other income support, or not being paid by an employer, self- employed or contract workers who do not eligible for El • Application open in April through a web portal or toll-free number.

Canada Child Benefit • Extra $300 per child • Families with children • Payment scheduled with CCB in May

GST Credit • Up to $400 per individual and $600 for a couple • Low-modest income families • 2018 tax filed • Special payment in May

BC Emergency Benefit • One-time payment of $1000 • El or Canada Emergency Response Benefit qualifiers • Payment in May • Application process to be announced

BC Climate Action Tax Credit • Up to $218.00 per adult and $64 per child • Low-modest income families • Payment in July

BC Hydro • Up to $600 grant • bill payment deferral • Financial hardship due to job loss or illness • Effective now

BC Temporary Rental Supplement Program (BC- TRS) • Up to $500/month towards rent & paid directly to the landlord • Low-moderate income families • Financial hardship due to COVID-19 • Early April on BC Housing website

Mortgage & Car Loan • 6 months payment deferral • Case by case basis with the associated lenders • Effective now

Student Loan • Payment not required for 6 months • No interest accrued for 6 months • Student loan borrowers • Effective March 30, 2020

Personal Income tax • Filing deadline - June 1., 2020 • Tax payment — Aug 31., 2020 • Taxpayers

Kids and Seniors: (Kids Helpline Funding $7.5 Million) + Seniors ($9 million through United Way Canada to help the country's older population get groceries, medication and other critical items)

Business loan: Access to necessary Credit. $40,000 emergency business loans. Interest-free for up to one year. Called Business Credit Availability Program (BCAP)

The situation is very fluid and more updates are happening daily. For Vancouver, Fraser Valley and Chilliwack residence. This is great news during a very stressful and unprecedented time in Canadian history.